So how do you create and follow financial priorities and goals? Maybe take a few lessons from the past. There are three rules that I learned growing up from the finest teacher I know – my Dad – that have made this task easier throughout my life, and they still apply today. I’m sharing them in hopes that they will inspire others. Of course, the dedication to follow them is the important part. And that’s not easy, but it can truly help make your money – and your life – count.

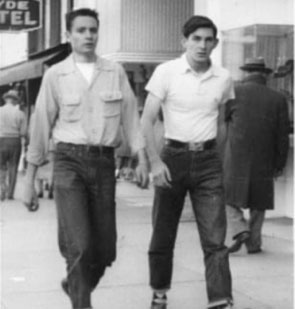

- Family Comes First. Dad, who built a home building company from the ground up, has always been a hard worker. He did whatever it took to provide for us. In 1970 he sold real estate in a then start-up company called Cooper Communities. Most will recognize this as Hot Springs Village in Northern Garland County (other communities include Bella Vista in Northwest Arkansas and Cherokee Village outside of Branson, Missouri). For four years he was the top salesman. And though he worked six+ days a week, Dad still found time to attend our ball games, plays, concerts and other functions of his five sons. One of his sayings that sticks with me is, “If a man won’t take care of his family he’s a ‘no count.’” What he meant by this was that any accomplishment – from an opinion to fame – doesn’t count for anything if he didn’t take care of the family.

- Failure Is Not Final. This is an especially useful lesson in today’s economy. Many have been furloughed or lost their jobs due to the pandemic and economic downturn. Some are even considering bankruptcy because they have no savings and have maxed out their credit cards instead of controlling their spending habits. Dad started his construction company in the mid-1970’s during what would become a very long recession. During that time, he also bought a controlling share in a cattle ranch as the country was coming out of a beef shortage and prices started to fall. One became a success, the other an investment that he sold below what he originally thought he would. But he always took personal responsibility and thanked God whether it was feast or famine. Dad used to say “You may not be responsible for getting knocked down. But you’re certainly responsible for getting back up.

- Invest for The Future. With seven mouths to feed, one would wonder how Dad saved money. The monthly grocery bills were never something I saw, though I did accompany my mother on the weekly Piggly Wiggly visits. I can remember buying four gallons of milk each time we went (in the old glass jugs – yum!). And, each of us were into so many different extracurricular activities as well – two were musicians and three played sports. The fees associated with kids playing sports and music lessons are something I am all too familiar with. But he and Mom were able to save money each month. Dad hired Vernon McCarthy – a pioneer in Financial Advice in Hot Springs – to help him invest. By following his advice he slowly was able to build a nice nest egg. They sent us all to college and managed to travel once we had all left home.

So on this Father’s Day, I just want to say “Thanks” Dad! You’ve been a great role model for us and you’re definitely one of my heroes.